Online 1099 Tax Form

Form 1099 Online Features

Each year, Form1099online reconfirms to us their huge value over any other service we’ve seen. No more paper, no mailing costs, and each recipient can retrieve their own form online.

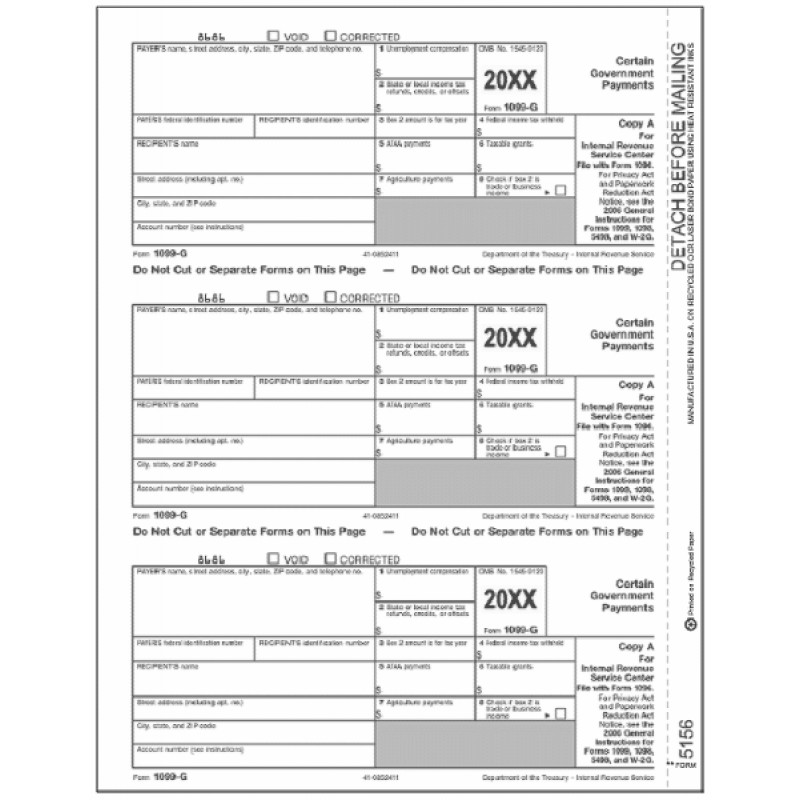

IRS Form 1099-K came into existence as part of the 2008 Housing Assistance Tax Act—even though it has nothing to do with housing. This form endeavors to ensure that all online retailers are reporting sales for tax purposes. It requires credit card companies, such as MasterCard and Visa, and third-party processors, such as PayPal and Amazon. A 1099-G is a tax form from the IRS showing the amount of refund, credit or interest issued to you in the calendar year filing from your individual income tax returns. Please note: to view your 1099 from any year, even if you exhausted your benefits, you must register to access the MyBenefits portal.

Business Owners

Save time by sending us your business info and recipient information, Form1099online will take care of the rest. Form1099online.com will transmit your form 1099s electronically with IRS and mail the copy recipient as per the request.

Accountant

If you’re an accountant and looking for an easy way to handle your clients 1099s, we can help you. You can get started by filling out the information and let us know if you have any questions about the process.

E-file & Compliance

Form1099online.com is approved by IRS as their certified efile service provider & tax partner. You can E-file IRS Forms 1099-NEC ,1099-MISC, 1099-K, 1099-INT & 1098.

Combined Federal/State Filing (CF/SF)

The Combined Federal/State Filing Program (CF/SF) is an information sharing agreement between the IRS and CFSF participating states. This programme allows IRS to send various 1099 forms information to their respective states. If the state is a CFSF programme participating state, they will receive the Form from the IRS directly.

Quick & Easy Setup

We made form 1099-NEC efile easy system. Our user-friendly software is designed to take the stress and confusion out of filing your 1099 forms. Form1099online.com takes you through a step-by-step wizard process to efile form 1099-NEC in few minutes.

State filing requirements

/1099-form-36a7b4ad438c4c1cbd53efb8e944cc6f.jpg)

Each state has individual filing requirements and deadlines. Some Combined Federal/State Filing programme participating states still require individuals to file with the state and some states do not participate in the Combined Federal/State Filing Program (CF/SF) at all.

Form 1099 in 2020: What is used for?Print Online 1099 Tax Form

Form 1099 is a form used for reporting different types of income, including interest, dividends, pensions, royalties, and certain payments by a business to its employees. Form 1099 is a multipurpose form which is used for reporting different types of income.Tax form 1099 is issued by the IRS to the lender at the end of the year. It includes the amount of interest the borrower has paid during the year. The lender then sends a copy to the borrower.

- If the borrower's total interest payments are $600 or more, the borrower must file Form 1040 and Schedule B. Tax form 1099 is issued to the borrower at the end of the year. The borrower must then report this interest on Form 1040 and Schedule B.

- If the borrower's total interest payments are $600 or more, the lender must send a copy of the filled form 1099 to the IRS. It can be set online.

- If the borrower is a corporation, the lender must file Form 1099-INT for each corporation receiving interest payments of $600 or more. The lender sends a copy to the borrower.

- If the borrower's total interest payments are $600 or more, the borrower must report the interest on Form 1120, U.S. Corporation Income Tax Return and Form 1120-A, U.S. Corporation Short-Form Income Tax Return.